Five Forces:

Ford

Today, we’ll use the Five Forces tool to analyze the forces that impact Ford Motor Company in the North American automotive market. The Five Forces framework is a valuable tool for companies that want to launch a new product or enter a new market.

What are the five forces?

Created by Michael Porter in 1979, the goal of the Five Forces framework is to analyze the impact the sources of competitive pressure have on the marketplace. The result, ultimately, is to determine the level of attractiveness for government independent industries and markets.

Market attractiveness is a product of two closely related things: the fierceness of competition within the market, and the potential profitability in the market. Typically, the market profitability potential is a function of the fierceness of competition. The more fierce, the lower the profitability.

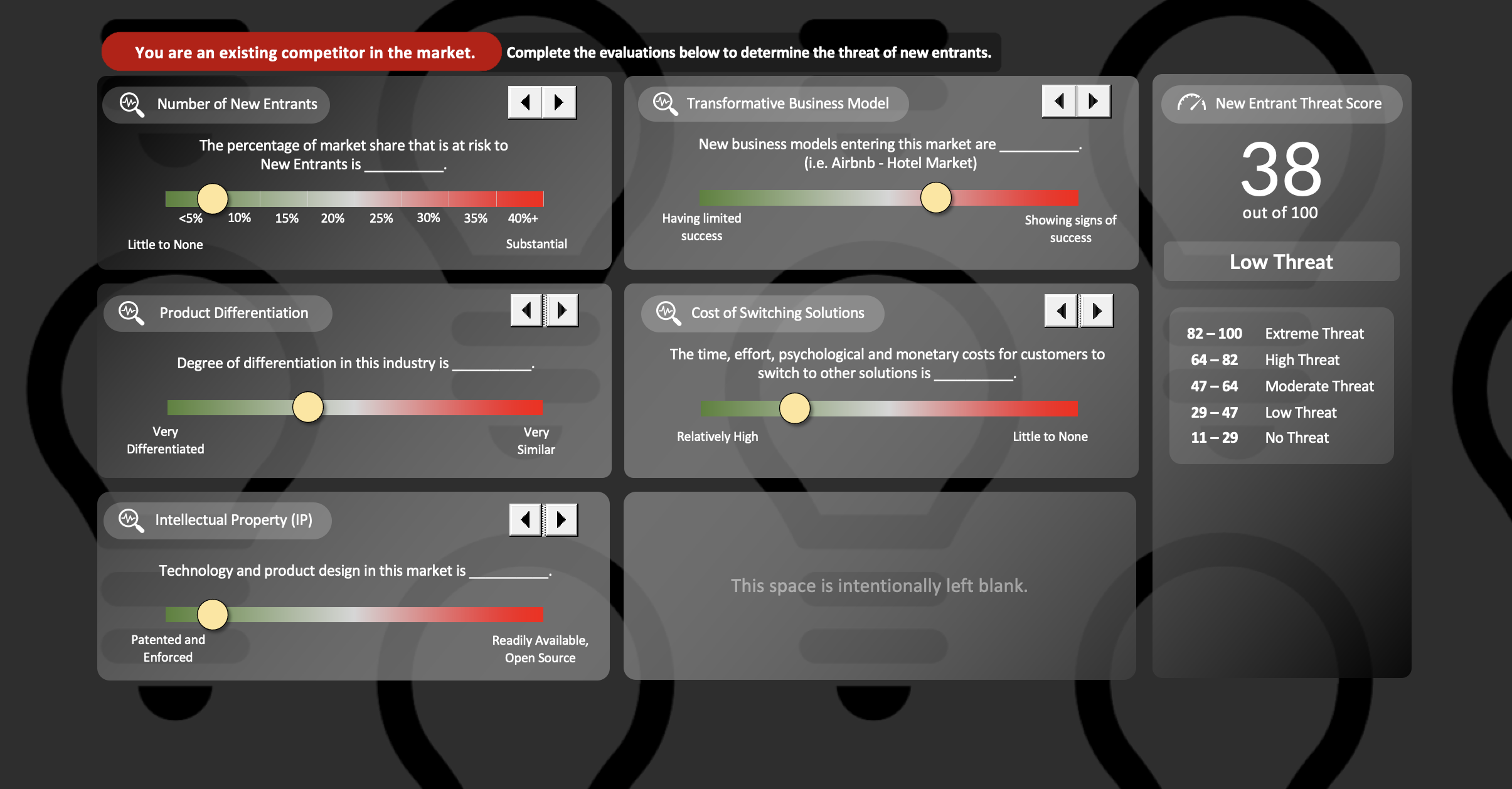

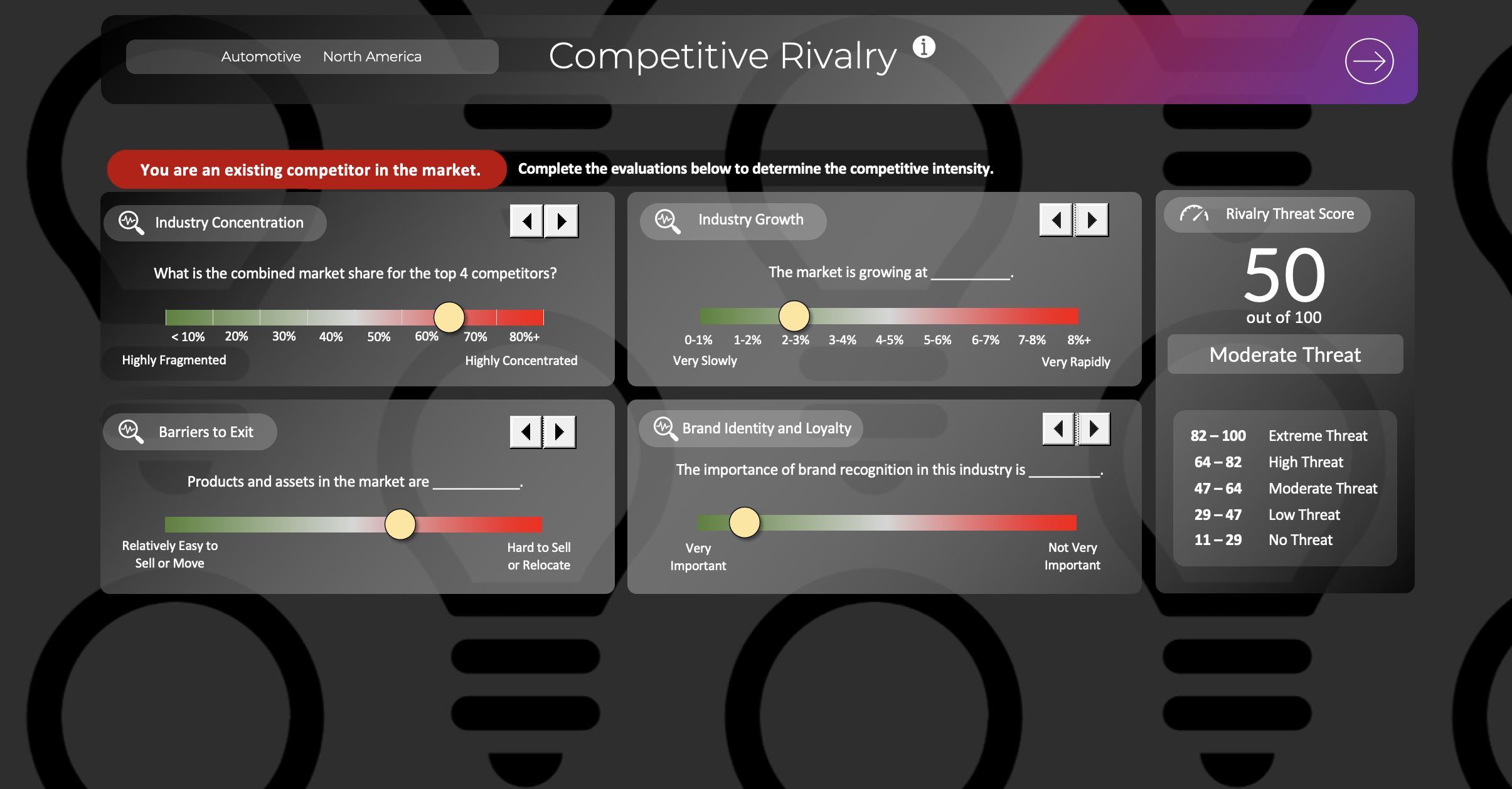

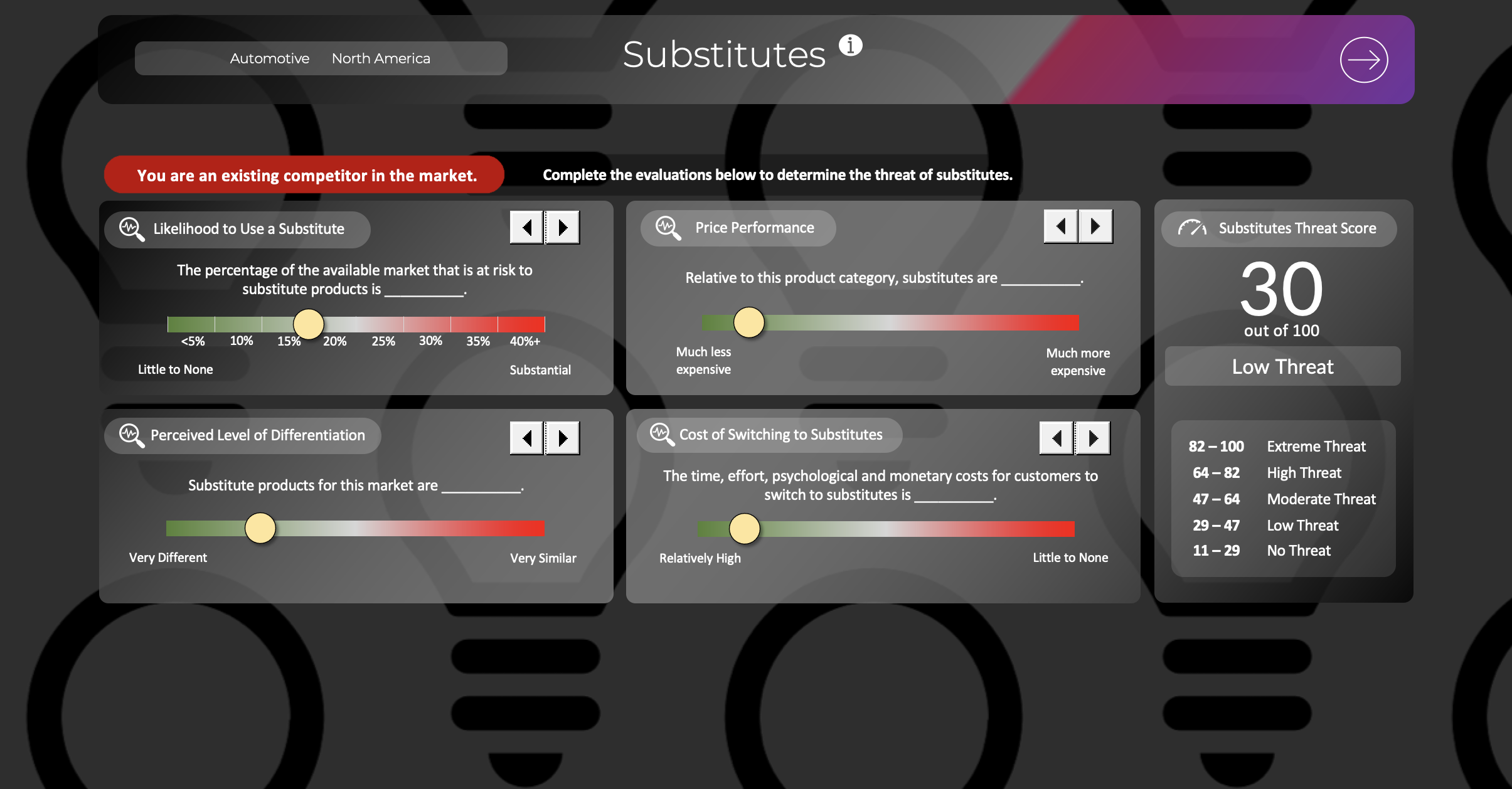

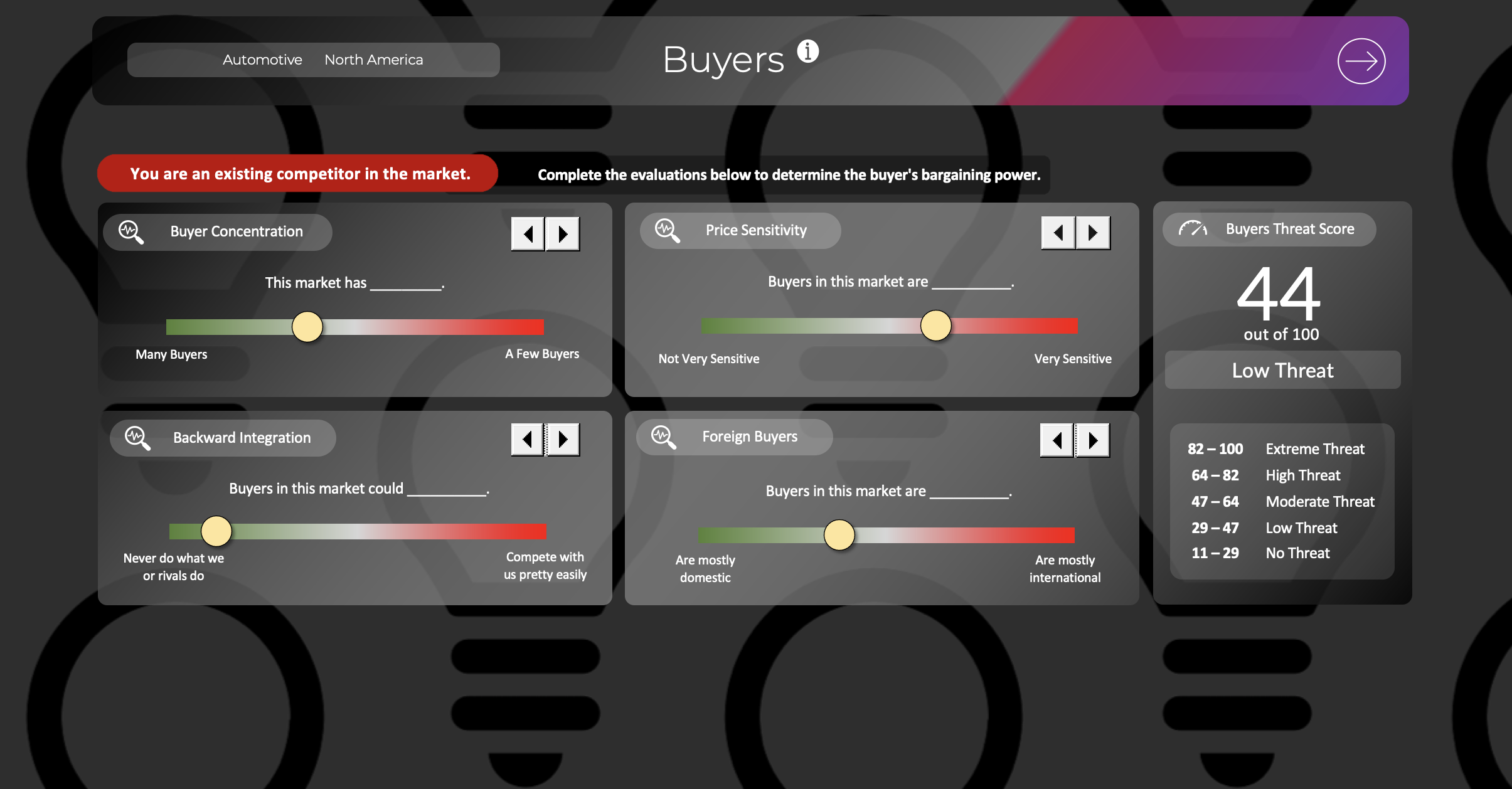

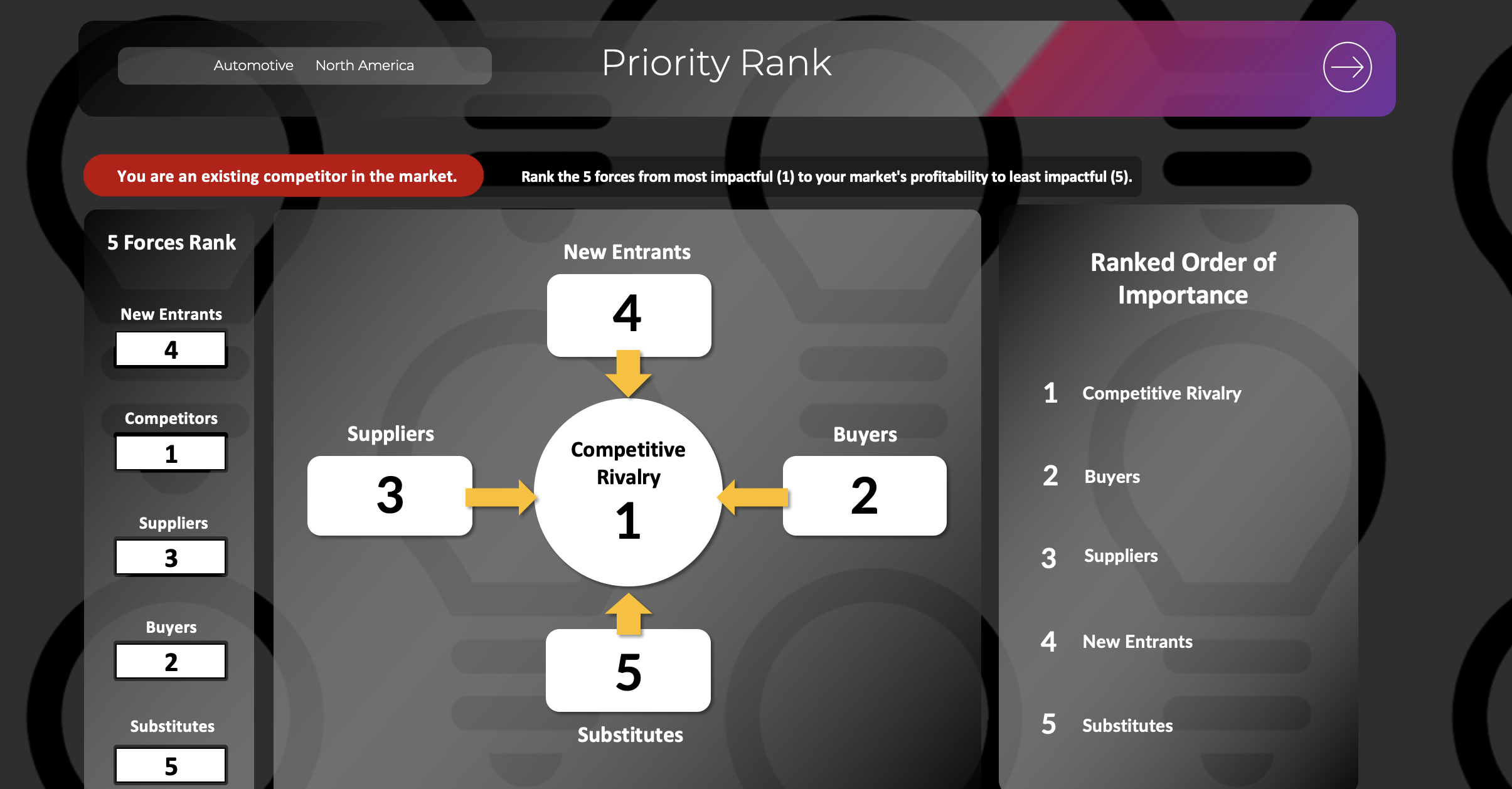

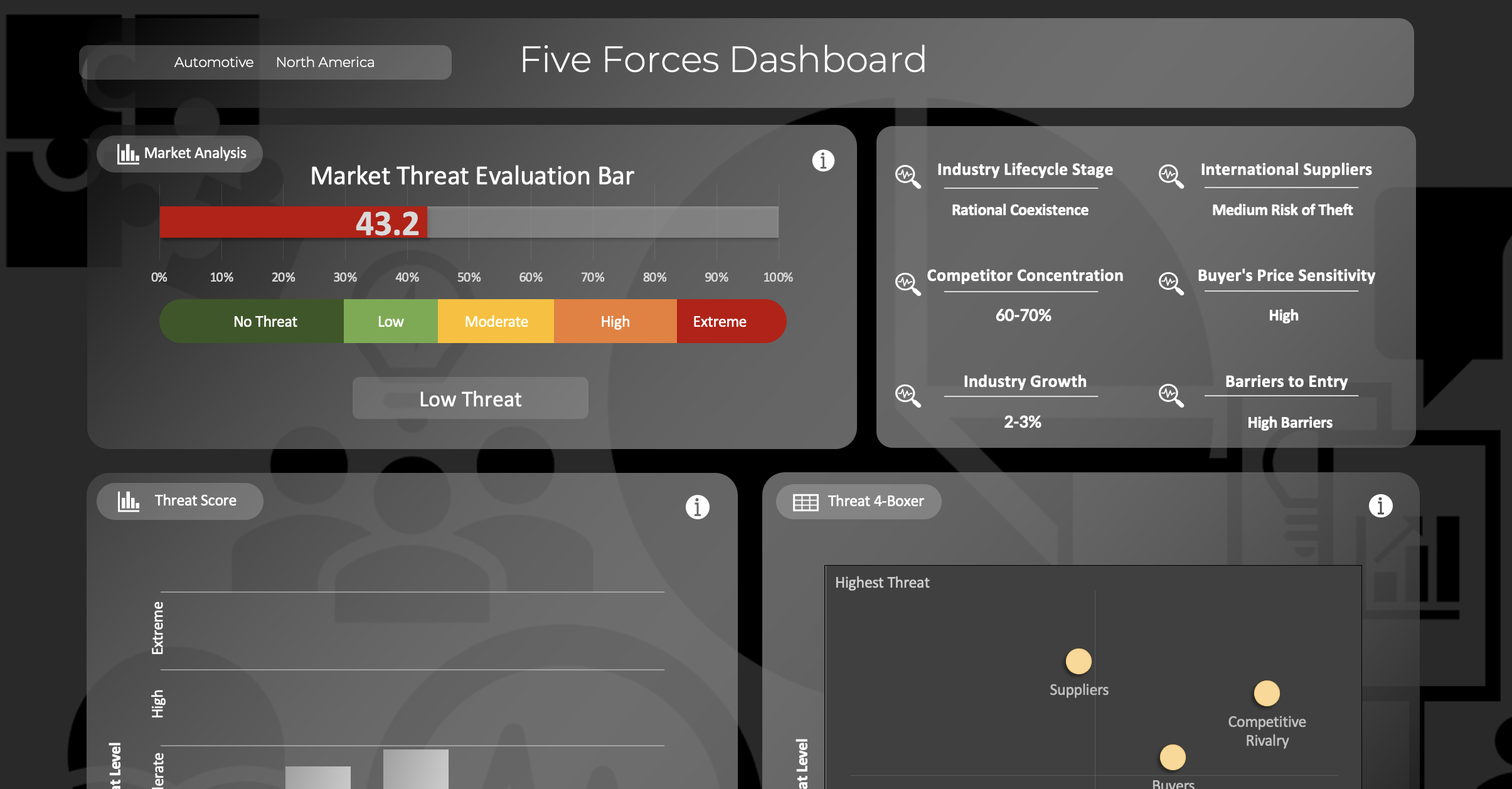

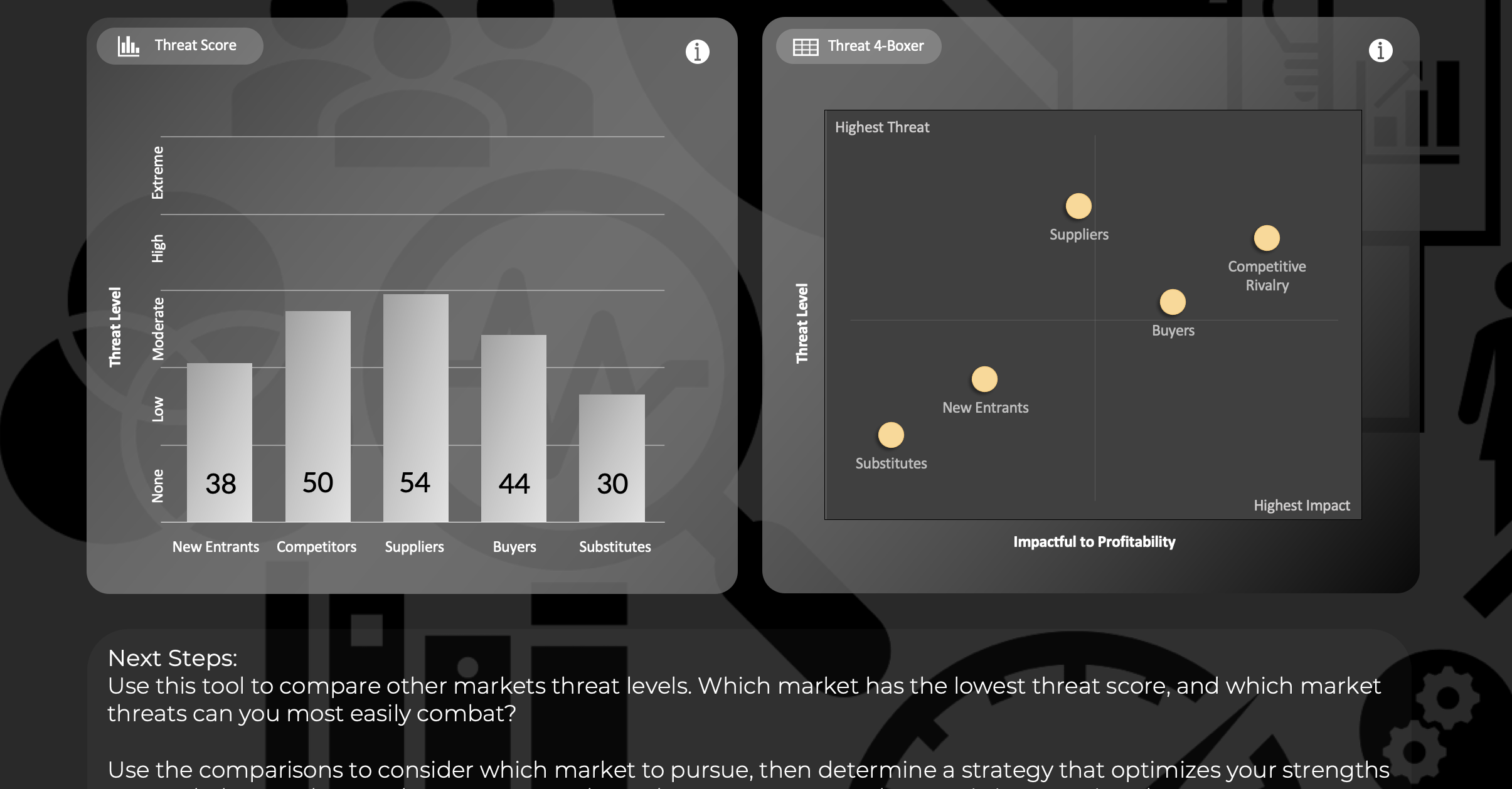

In this framework, the process is to analyze the five forces by independently evaluating the factors inside each force. After completing the evaluations, the results on the dashboard quantify the threat of the market and provide a snapshot of the forces that have the highest impact and highest threat.